Top 10 Cryptocurrencies To Invest In 2021 – CoinSutra Picks

- What are the best cryptocurrencies to invest in 2021 for the long term?

- What are the best altcoins to invest in 2021?

- What are the most important cryptocurrencies other than Bitcoin?

Do you wish to know the top 10 Cryptocurrencies to Invest in 2021? Then, you have just arrived at the right place.

We have collated a list of our top crypto projects for you that have massive potential to grow in 2021 and beyond. These projects are fundamentally strong in their business utility and have a solid community that can take them to the moon.

Fundamental Analysis Process of CoinSutra

Before sharing my list, we would like to talk about our process of choosing these tokens. We have designed this portfolio on four parameters.

1. First is Diversification

We have diversified the portfolio over the various growing industries in crypto such as Blockchain Network, DeFi, Gaming, Metaverse, Insurance, Exchanges, Oracles, etc. Don’t worry if you don’t know these terms; we will simplify these for you in a short while. Basically, diversification will spread your risk over the various sectors of the crypto market.

2. Second is the Market Cap

To help you with a proper portfolio allocation, we have picked up a mix of Mid Cap and Large Cap Tokens.

Mid Cap Tokens are the ones that can make life-changing money for you. However, they are equally risky to invest in.

Therefore, to balance out the risk, you need to invest in Large Cap Tokens, which act as a safe haven in this market. These tokens may not grow like a Midcap token, but they also don’t bleed like them in a bear market.

3. Third is the Business Use Case of a Project

A crypto project is valuable only because of the value it gives to the Crypto Industry. The utility provided by a project to its users is the ultimate parameter to decide its fate in the market.

Therefore, we have extensively researched the business use cases of the listed projects and compared their strengths against their competitors.

4. Fourth and the last is Community Engagement –

A crypto project needs a loyal community to grow and get adopted on a large scale. The team behind the project needs to ensure that people believe in them and the project adds some real value to the world.

All these listed projects have a strong community backup.

Now, let us get some things straight.

Please note that this article is for educational purposes only. We are not financial advisers, and this is not financial advice. Please consult your financial advisor before making any investment decision.

Now, let’s cut to the chase and start with our top 10 crypto projects.

Top 10 cryptocurrencies to invest in 2021

1. Bitcoin (BTC)

Our first project has to be the King of the crypto market, i.e., Bitcoin. Bitcoin is a form of Digital Money that has proved to be a great alternative to our existing financial system.

It is a peer-to-peer network built on a Distributed Ledger Technology called blockchain, making the network secure and decentralized. The token to fuel up this network is also called Bitcoin (BTC).

The network is run by an open-source code, and this code is the law behind this digital money. No Government, person, or organization can control it or confiscate it.

Moreover, the supply of BTC tokens is limited to 21 Million, making this cryptocurrency scarce in nature and inflation-free. Thus, bringing back the era of inflation-free money.

Bitcoin was established in 2009 by Satoshi Nakamoto, a pseudonym whose identity is not known to anyone in the world. The concept of this new money was so revolutionary that it quickly built up a great community around itself.

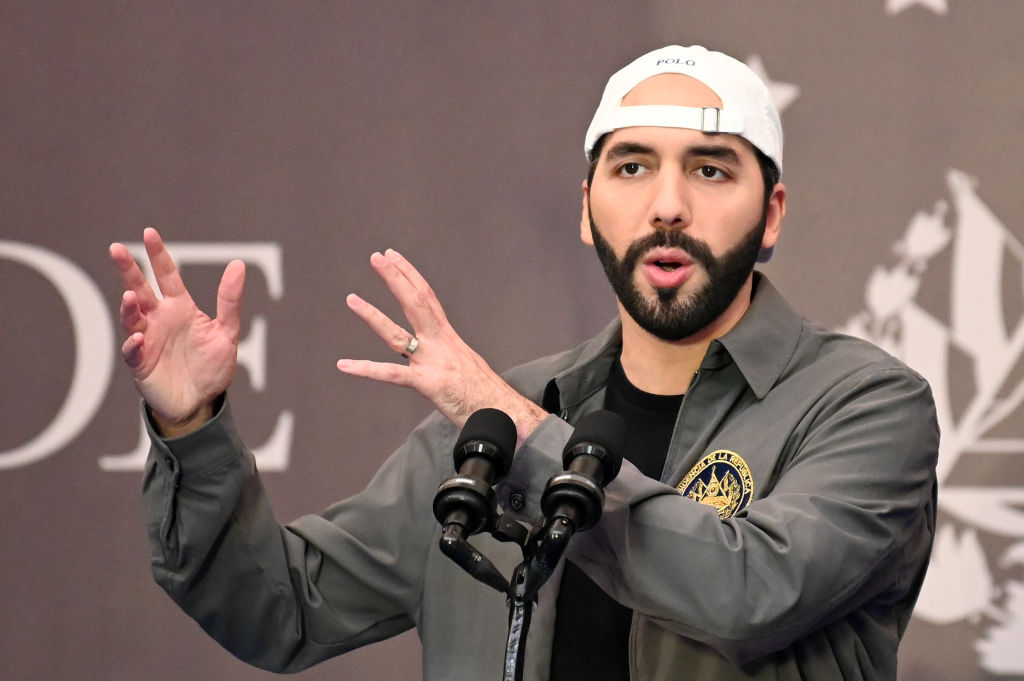

But today, it’s an entirely different story. BTC is considered money in many parts of the world. Places have Bitcoin ATMs to convert your BTC into cash or vice versa. Not only this, recently, El Salvador has become the first country to declare Bitcoin a legal tender. This means that Bitcoin is as good as the national currency of the country.

As BTC is now accepted as a store of value and a medium of exchange throughout the world, it has got the crown title of Digital Gold.

Today Bitcoin is the most dominating cryptocurrency in the market, with a market cap of $918 Billion at the time writing this article. To give you a perspective, the Bitcoin market cap is 44% of the Market Cap of the total crypto market.

Since its inception, BTC has proven its metal and still has the substantial potential of an upside. As the adoption of cryptocurrencies would increase, BTC would get scarcer and keep rising in value.

Therefore, Bitcoin would hold the No. 1 position in our list for the foreseeable future.

Available on all major exchanges. See here: How to buy Bitcoin

2. Ethereum (ETH)

Our second choice is Ethereum.

Blockchain technology has indeed changed the dynamics of global technological innovation.

But, the most significant invention in the crypto industry after blockchain is smart contracts.

A smart contract is an improvised version of a traditional contract where there is no need for a third party to ensure the execution of the contract.

Suppose John wants to buy BTC by paying USD. He meets David, whom he doesn’t know or trust, and David offers him to sell BTC in exchange for USD.

To execute this transaction in the traditional world, John and David would need to find a trusted third party such as a bank to ensure that this transaction takes place as decided. For this, the bank would take a big chunk in the form of a transaction fee.

A smart contract is a piece of code that can execute a contract in a trust-less and secure manner without a third party. These codes are written in an IF-THEN relationship. Let’s understand how John’s transaction would look like in a smart contract scenario.

John’s USD would be locked in a smart contract, and once David transfers his BTC to John, the locked USD would be released to him automatically. Thus, a smart-contract transaction reduces the human element from execution and eliminates the chances of fraud and error. Further, the transaction fee for these contracts is substantially lower than what is charged by intermediaries in a traditional contract.

Smart contracts opened up a Pandora Box for the possible use cases of blockchain technology. Now, we could have blockchain-based banks, exchanges, insurance companies, marketplaces, and whatnot. And all this is just written on a code without any human involvement in the transaction.

Vitalik Buterin is credited with the implementation of smart contracts on a blockchain network called Ethereum. The platform was launched in July 2015 by a group of crypto enthusiasts, including Vitalik, who is one of the platform’s co-founders.

Except for the smart contract feature, Ethereum is similar to the Bitcoin Network. But the smart contract features drastically increased the possible use cases of the Ethereum network.

Now, a developer could build a smart contract-based application on Ethereum, which would run on its own once deployed. These are known as Decentralised Applications or DApps.

Currently, there are more than 2800 DApps on Ethereum which is like over 80% of the total DApps in the world. DApps related to Financial Services, Marketplaces, Social Media, Security, wallets, exchanges, Games, Virtual Reality are already built on Ethereum. Further, additional use cases of this network are being explored by the developers every day.

Ether (ETH), the native token of the Ethereum network, is the second-biggest cryptocurrency in the cryptoverse with a market cap of $385 Billion at the time of writing this article. Ethereum Market cap is 18.5% of the Market Cap of the total crypto market.

Further, the potential to which ETH can grow is unlimited, and so far, we have just scratched the surface about what we can do with smart contract technology. In our opinion, if any cryptocurrency could ever take over the value of Bitcoin, then Ethereum is the only possible contender in the market at the moment.

Available on all major crypto exchanges. Check out how to buy ETH

3. Chainlink (LINK)

The next big thing on our list is Chainlink.

We just discussed how beneficial smart contracts are for the development of Decentralised Applications. But there was a problem with smart contract technology. They worked in isolation.

For example, suppose we write a smart contract as follows:

If Barcelona wins an ongoing match, Then I would pay you 1 BTC and vice versa.

So, If Barca wins, you get 1 BTC, and if Barca loses, I get 1 BTC.

But, to execute this smart contract, the result of the match needs to be fed in the contract, which is not stored on the network. Therefore, without a real-world data feed, the use cases of these smart contracts are minimal.

So, to maintain the utility and security of smart contracts, we needed a decentralized off-chain data provider, also known as an Oracle.

Chainlink is a decentralized oracle network that enables smart contracts to securely interact with real-world data and services outside blockchain networks.

Chainlink solved the most critical bottleneck of smart contracts and, i.e., off-chain data. Just imagine the endless use cases it has.

- A Decentralised crypto exchange needs a price feed for cryptocurrencies.

- Location data is required to be incorporated in supply chain smart contracts.

- For betting, we need information related to event results. Etc.

Now, why are we betting big on Chainlink?

It’s pretty simple

- The adoption of smart contracts is growing every day

- This would further increase the demand for a decentralized oracle for smart contracts

- Chainlink is the biggest and most trusted player in this category

Further, Chainlink has established a significant number of partnerships in the crypto and the non-crypto market. As of 31 July 2021, Chainlink has been integrated with 679 projects, including Google, Polkadot, Binance, Coingecko, AAVE, and many more.

LINK is the native token of Chainlink Network. It has a Market Cap of $12 Billion, which is way below its true potential. Therefore, a significant upside can be expected from this token.

Buy LINK on:

- Binance

- Coinbase

- FTX

4. Polkadot (DOT)

The next project that deserves 4th place on our list is Polkadot.

Polkadot is a blockchain network that has an exceptionally unique design. It is a multi-chain network that connects different blockchains into a single unified network. Thus, allowing cross-chain interoperability throughout the network.

To give you a perspective, an application built on the Ethereum network cannot be used on any other network such as Bitcoin Network. But, Polkadot, with its multi-chain design, can connect these networks as one extensive, unified network. Therefore, one application can be used by two or more networks. This improves the overall efficiency crypto market.

So, if Chainlink builds an oracle on Polkadot, it can provide off-chain data to any other blockchain network connected to Polkadot. This reduces Chainlink’s resource requirement as it does not need to connect with so many blockchains which need regular off-chain data.

Because Polkadot tries to connect all the blockchain networks as one network, it is also known as the internet of blockchains. The blockchains in the network are known as “parachains” which work parallelly at the same time.

Polkadot parachain design allows a number of blockchains to work simultaneously at the same time. Therefore, Polkadot is a faster network than Ethereum.

Just to give you a perspective, the current Transaction Per Second (TPS) rate on Ethereum is 15-20 transactions. After its biggest upgrade, i.e., Ethereum 2.0, this TPS is expected to increase up to 100,000.

Whereas Polkadot without the parachains has a TPS of 1000-3000 transactions. Once the complete network is active along with parachains this TPS is expected to grow upto 1 Million.

Polkadot was Launched in 2016 by Web3 Foundation and Parity Technologies. The man behind the network development is Dr. Gavin Wood, who was also the co-founder and CTO of Ethereum.

The other two co-founders are Robert Habermeier And Peter Czaban, who have substantial experience in the technology and blockchain industry.

In short, the Polkadot has significantly improvised the design of the Ethereum Network. Therefore, the project is expected to have a bright future ahead.

DOT is the in-house token of Polkadot Network, and it can be used for governance of network, Staking, and Bonding. With a market cap of over $28 Billion with a token price of around $29, Polkadot is among the top 10 crypto projects basis market cap.

Buy DOT on:

- Kraken

- Gate.io

- Binance

5. Uniswap Exchange (Ticker: UNI)

The next CoinSutra Crypto Pick on our list is Uniswap.

Uniswap is a Decentralized Crypto Exchange (DEX) Application built on Ethereum Network. The exchange is built on a smart contract and does not need any human to run or manage it.

The most essential features of the exchange are:

- First, it does not know the identity of the buyer or seller. So, you can have complete anonymity on the platform.

- Second, it does not have the custody of funds of the buyer or seller. So, you have complete control over the funds.

- Third, the transaction is done without any trusted intermediary with the help of a smart contract.

Further, people who hold their crypto funds for long-term gains, also called HODLers, can lend their assets to Uniswap and earn additional rewards on it.

Uniswap was developed by Hayden Adams in November 2018. Adams was introduced to cryptocurrency by a friend and was quickly inspired by Vitalik Buterin, Co-Founder of Ethereum. To launch his project, Adams received a grant of $65,000 from the Ethereum Foundation.

Today those $65,000 have a market cap of over $15 Billion. UNI is the in-house token of the platform, which can be used for governance and staking on the platform.

The extent of safety and anonymity that Uniswap provides to a user would only attract more business to the platform in the future. Therefore, the UNI token should be in your portfolio.

So, we are halfway there. As I have given our top 5 picks to you, Let me know your top 5 tokens in the comments section.

Buy UNI token on:

- Binance

- Huobi

- Coinbase

- FTX

6. Terra Network (LUNA)

The next gem on the list is the Terra Network.

Terra is a Blockchain Network that uses smart contracts to build Decentralised Applications on the platform. The unique part of this network is the design of stablecoins on the platforms.

Stablecoins are tokens that remain relatively stable over a long period, such as USDT, BUSD, USDC, etc.

Terra network also has its stablecoins. UST (Terra USD) is the most used stablecoin on the platform. This is an algorithm-based stablecoin. This means that UST derives its value from another token called LUNA, which is the native token of the network.

To issue UST, the platform would need to burn the equivalent value of the LUNA token. This means that as the adoption of Terra Network increases, demand for UST would increase, which would require the burning of more LUNA tokens. This would reduce the supply of LUNA tokens and increase their value over time.

Terra Network was built in 2018 by a South Korea-based company named TerraForm Labs. The co-founders of the platform Do Kwon and Daniel Shin earlier has a payment gateway business called CHAI which was a huge success in South Korea. This userbase helped with the mass adoption of the Terra Network.

There are many useful applications on the network, such as

- Anchor Protocol – which gives a stable 20% return on the stablecoins

- Mirror Protocol – which is a synthetic assets platform

- Spar Protocol – which is a crypto asset management protocol. And many more.

The whole system uses Terra stablecoin, which ultimately boosts the value of LUNA.

LUNA is the governance token of the platform and can also be staked to earn additional income. The current market cap of LUNA is over $11.5 Billion.

Out of all the projects in our top 10 list, we are most bullish about LUNA. It has a strong use case and is highly undervalued at the moment.

Buy LUNA on:

- Binance

- Gate.io

- WazirX

7. FTX Exchange (FTT)

The next pick on our list is a crypto exchange token called FTT by FTX exchange.

FTX Exchange is a centralized crypto exchange that not only has all the essential features but also has many unique products such as Tokenised Stocks, Leveraged Tokens, Prediction Markets, etc. (You can read our full review on FTX Exchange to know more about these products)

The exchange has a state-of-the-art user interface with a mobile application for android and iOS devices.

But USP (Unique Selling Point) of the exchange is the team behind the platform and their prior work experience.

FTX team comes from some of the leading Wall Street quant funds and tech companies. The co-founders of the exchange are Sam Bankman Fried and Gary Wang had a previous venture called Alameda Research, a quantitative crypto trading firm.

FTT is the native token of the FTX Exchange and is the backbone of the whole FTX ecosystem. The token has a current market cap of over $5 Billion.

It’s important to note that FTX is amongst the top 5 crypto exchanges in the world in terms of the trading volume. In this context, the current market cap of the exchange is highly undervalued.

So, get some FTT for yourself.

Buy FTT on:

- FTX

- Binance

8. Decentraland (MANA)

The next project on our Moonshot list is Decentraland.

Decentraland is a decentralized virtual world built on the Ethereum network. The project is a combination of Virtual Reality, Gaming, and Blockchain Technology.

The virtual world on Decentraland is divided into pieces of virtual land that you can purchase and own in the form of Non-Fungible Tokens. (To know more about NFT – you can read our NFT guide here)

So, the project is about owning virtual properties and doing everything that you can do with real estate in the real world. You can open a business, rent the property, place an advertisement, conduct an art exhibition, and whatnot.

It is pretty difficult to believe that someone is buying a virtual piece of land for real money. But, a few weeks back, a piece of land was sold on Decentraland for $900,000.

Moreover, the project has come a long way today. From a barren land, Decentraland today has some exciting running projects such as

- It has a casino named Decentral Games where you can gamble with people. Wait! There is more to it; Decentral Games has hired actual employees to greet and host guests in their virtual casino. You can also apply for this job. (Read our full research report on Decentral Games and $DG Token here.)

- Kraken has its Headquarters in Decentraland.

In short, Decentraland is one of those projects which are leading the technological innovation of Virtual Reality and taking it to the next level. Not only this, but also they have proved the real money value of a digital asset such as digital real estate.

The project has the potential to become a significant player in the Virtual and Augmented Reality space.

MANA is the in-house token of Decentraland and is used as a currency for activities such as buying the virtual land, buying an artifact or playing games, etc. MANA is also used to govern the Decentraland platform.

Currently, the token has a Market Cap of over $1 Billion, which is undervalued for a project that has the potential to be a self-sustained decentralized virtual economy.

Buy MANA on:

- Binance

- WazirX

9. Lido Finance (LDO)

The Next project is very unique and has a great potential to grow in the next 3-4 years. It’s Lido Finance.

Currently, when you stale your crypto assets on a platform, you cannot do anything with them till they are unstaked. Further, there is a lock-in period after unstaking before these assets are available to you.

Lido Finance is a Liquid Staking Service that allows you to stake your assets and also provides you liquidity during the period in which these assets are staked. (To know more about staking, you can read our Staking Guide here.)

For example: when you stake ETH on Lido Finance, you get a derivative token called stETH. Now:

- You can provide liquidity to stETH Liquidity pool on Curve and earn rewards,

- You can deposit stETH on Yearn Finance to maximize your yield,

- You can lend your stETH on AAVE and earn interest on it.,

- You can sell your stETH on 1Inch Exchange,

- You can convert your stETH to bETH and use it to borrow UST (Terra USD) on Anchor Protocol and earn a stable return of 20% p.a., and many more

Although Ethereum staking rewards are around 5%, your net return would be much higher than that. In addition to staking rewards, the platform provides you liquidity which can be further used on many DeFi platforms to earn additional income.

Lido has an in-house token called LDO, which is used for the governance of the platform. Working as the backbone of the Lido Ecosystem, the LDO token keeps the whole platform decentralized.

The current Market Cap of LDO is $226 Million and has a substantial upside from this price point.

Disclaimer – At the time of the launch of the project, 64% of the total supply of tokens was dedicated to the founders, developers, and early participants of the platform. This 64% was locked for a period of 1 year, and these will be unlocked on 17 December 2021 with a vesting period of 1 year. Once these tokens are vested, a substantial supply of tokens would be available in the market and could affect the token’s price significantly.

Buy LDO token on:

- MEXC exchange

- HOO exchange

10. Nexus Mutual (NXM)

The last project on our list is Nexus Mutual.

It is an Insurance Protocol that allows you to take insurance against loss of crypto funds.

Over the past years, we have seen several cases where people have just forgotten their private keys and lost their crypto assets. Further, after the invention of smart contracts, crypto funds can be locked in a contract. But these smart contracts are prone to hacks, and we notice these hacks frequently in Decentralized Finance (DeFi) Protocols.

Due to this reason, DeFi is the least adopted sector of crypto adopted by institutional investors. To ensure a mass adoption of Smart-contract-based applications, the industry needs to ensure that the risk of loss of funds through these protocols is eliminated or at least reduced to some extent.

Insurance is a way to mitigate this risk. Nexus Mutual is the insurance protocol by which users can cover their losses due to smart contract failures. This is known as Smart Contract Cover.

Further, the excess in the pool of funds received from selling covers is distributed back to the members who have purchased these covers.

The reason this project is in our top 10 list is that

- It opens the door for better adoption of crypto and specifically DeFi

- It is the lead project in the Insurance Niche

NXM is the native token of the Nexus Mutual. NXM holders can purchase smart contract cover, stake the token, and use it for governance purposes.

NXM currently has a market cap of over $ 841 Million and can be a massive hit once DeFi is secure enough for institutional adoption.

Buy WNXM (Wrapper NXM) on:

- Binance

- Gate.io

- CoinDCX

Conclusion: CoinSutra Top Crypto Picks for 2021

So, this is the list of our top crypto picks for 2021 and beyond. We have created a google sheet and have recorded the current price of these tokens and will revisit the sheet in few months to calculate how much money we all have made.

If you agree with our picks, then please share this post as much as possible. If you have some other exciting tokens in your portfolio, let us know in the comments section below.

For more such posts subscribe to CoinSutra Newsletter.

News appeared first on: Coinsutra.com